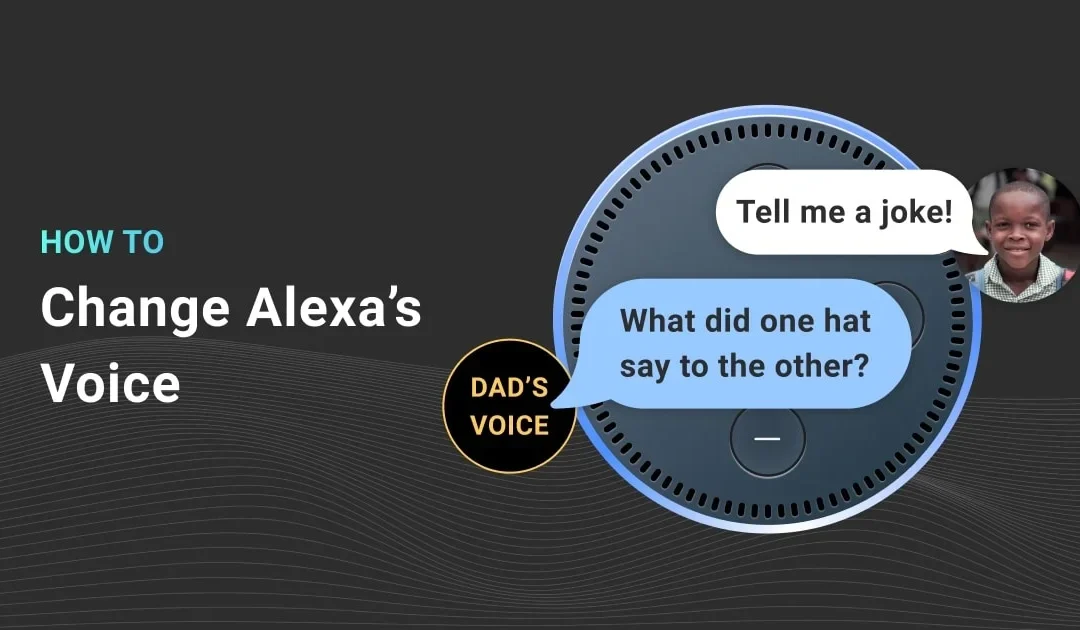

Tech giants – from Apple to Google – are busy building the technologies that will enable voice-directed control of our everyday activities. Virtual assistants, such as Amazon’s Alexa and Apple’s Siri, will be accessible nearly wherever you are, because voice-controlled, cloud-computing software will be built into just about every new gadget, appliance, vehicle and building. In the next few years, a “cloud” of authentication will follow you from location to location thanks to multi-device triangulation. And it’s largely thanks to biometric authentication.

Passwords are dead. It’s a declaration that’s becoming truer with time.

Traditionally, there’s been an inverse relationship between security and convenience, when it comes to granting consumers access to their personal accounts, from social media to financial. But fast and frictionless is what all consumers want, so a smooth security and authentication flow is essential. Thankfully, voice authentication is starting to bridge the gap, so security and convenience are no longer mutually exclusive.

Soon, we’ll all be able to employ simple voice commands to direct our worlds. And since money makes the world go ‘round, banking and payments will need to play a part.

Voice banking is gaining traction in conjunction with the rising adoption of digital voice assistants. Smart speaker ownership in the United States reached 157 million in December 2019, up from 119 million a year earlier, according to NPR and Edison Research.

Banks and credit unions of all sizes have already recognized and responded to the trend – from community banks like Alablama-based Bank Independent (check out my recent discussion with Bank Independent’s Kelly Burdette and Voice Tech Podcast’s Carl Robinson on voice banking technology) to Bank of America, which offers virtual voice assistant Erica. By adopting the technology now, these financial institutions are getting ready for the future voice-directed world.

Years ago, many banking industry veterans were naysayers about the stickiness of ATMs. Who would want to use a machine to handle their everyday banking? Fast-forward to today: There are over 400,000 ATMs in the United States, according to TransferWise. Voice banking is likely to follow a similar trajectory, despite doubters. Voice assistants, such as Amazon’s Alexa and Google Home, are the fastest growing technologies since the smartphone, and their “skills” are proliferating every day.

Voice banking protected by voice biometric authentication will give consumers the confidence to take advantage of the convenience they crave. Imagine remembering, as you’re driving home from a late dinner, that your credit card bill payment is due that day. Rather than having to pull over and pull out your smartphone to pay via your banking app or log onto your laptop before climbing into bed, you’ll be able to tell Alexa – via voice-controlled, cloud-computing software built into your car – to handle the payment for you.

The voice banking offerings that we’re seeing today are just the beginning. Companies like Ann Arbor, Michigan-based Clinc are working day in and day out to advance conversational AI technology, which will enable a natural-language, conversational banking experience.

Get ready…fast and frictionless banking will soon be a reality thanks to new advancements in voice technology.

Stacey Zuniga is Vice President of Financial Services at ENACOMM (www.enacomm.net), a leading fintech provider of customer authentication and intelligent interactions technologies.